The Main Principles Of Hard Money Georgia

Wiki Article

Facts About Hard Money Georgia Uncovered

Table of ContentsSome Known Factual Statements About Hard Money Georgia What Does Hard Money Georgia Do?The 25-Second Trick For Hard Money GeorgiaThe Greatest Guide To Hard Money Georgia

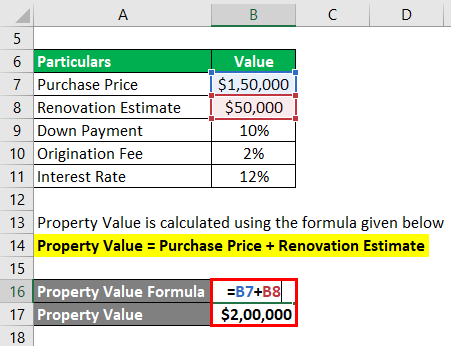

The optimum acceptable LTV for a hard cash lending is typically 65% to 75%. That's exactly how much of the property's expense the loan provider will be ready to cover. For instance, on a $200,000 house, the optimum a difficult money loan provider would certainly agree to offer you is $150,000. To buy the home, you'll have to generate a down settlement huge enough to cover the remainder of the purchase rate.You can qualify for a tough cash lending much more rapidly than with a typical home mortgage lender, and the bargain can shut in a matter of days. Hard cash loans tend to have higher interest prices than standard home mortgages.

By comparison, rate of interest rates on difficult cash financings begin at 6. Tough money lenders commonly charge factors on your lending, occasionally referred to as source charges.

Points are normally 2% to 3% of the financing amount. 3 factors on a $200,000 funding would be 3%, or $6,000. You may need to pay even more points if your finance has a greater LTV or if there are multiple brokers associated with the purchase. Some lenders charge just points as well as no various other charges, others have extra costs such as underwriting charges.

The Hard Money Georgia Ideas

You can expect to pay anywhere from $500 to $2,500 in underwriting fees. Some hard cash loan providers also bill early repayment fines, as they make their money off the rate of interest charges you pay them. That means if you repay the funding early, you may have to pay an extra cost, adding to the finance's expense.

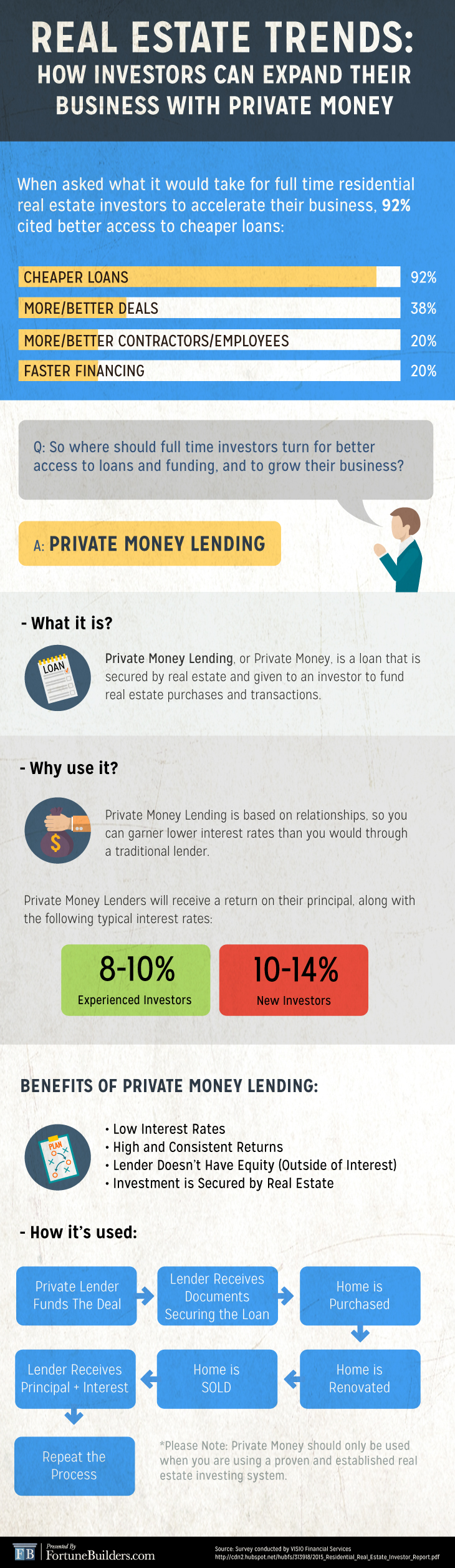

This indicates you're extra likely to be provided financing than if you got a standard home mortgage with a questionable or slim debt background. If you need money promptly for renovations to flip a house commercial, a difficult cash financing can give you the cash you require without the inconvenience as well as documentation of a standard home loan.

It's a method investors make use of to acquire financial investments such as rental buildings without using a great deal of their own assets, as well as tough money can be valuable in these circumstances. Tough money finances can be valuable for real estate financiers, they must be utilized with care especially if you're a newbie to real estate investing.

If you fail on your funding payments with a hard money loan provider, the repercussions can be serious. view it Some car loans are directly assured so it can harm your credit scores.

What Does Hard Money Georgia Do?

To discover a trustworthy lender, speak to trusted realty representatives or home mortgage brokers. They might have the ability to refer you to loan providers they have actually worked with in the past. Tough money lenders additionally often attend real estate capitalist meetings to ensure that can be an excellent area to get in touch with lenders near you.Equity is the value of the residential or commercial property minus what you still owe on the home loan. The underwriting for residence equity loans likewise takes your credit scores history and also earnings right into account so they tend to have reduced passion rates and longer payment periods.

It can additionally be labelled an asset-based car loan or a STABBL funding (temporary asset-backed bridge car loan) or a swing loan. These are originated from its particular short-term nature and the need for substantial, physical collateral, generally in the kind of real estate home. A hard money car loan is a loan kind that is backed by or secured making use of a real estate.

The 45-Second Trick For Hard Money Georgia

They are considered short-term bridge financings as well as the significant usage case for difficult money financings is in from this source real estate transactions. They are taken into consideration a "tough" money lending as a result of the physical possession the property building needed to secure the loan. In case a borrower defaults on the lending, the loan provider reserves the right to think ownership of the residential or commercial property in order to recover the loan amount.

This is why they are mostly accessed by genuine estate business owners who would usually call for rapid financing in order to not lose out on warm possibilities. In enhancement, the loan provider primarily thinks about the worth of the asset or residential or commercial property to be acquired instead of the debtor's personal finance background such as credit report or income.

my review here A conventional or small business loan might occupy to 45 days to close while a tough cash loan can be enclosed 7 to 10 days, occasionally quicker. The ease and speed that tough cash loans offer continue to be a major driving pressure for why real estate financiers select to use them.

Report this wiki page